The United Nations Environment Programme Finance Initiative (UNEPFI) established the Principles of Responsible Banking in 2019, aiming to align the banking community with pro-social and environmental expectations and build an industrywide framework for positive action. To date, 190 banks representing 1.6 billion customers and nearly 40 percent of global banking assets have signed on.

The conversation so far has placed a significant focus on climate change — largely owing to matters of broad public discourse and concern — with banks eyeing net-zero emissions targets for their investments and debt financing decisions. Both Morgan Stanley and HSBC have announced net-zero financed emissions strategies by 2050, pledging to embed potential climate change risks and opportunities into their core business.

The world is changing. And whether that change is for better or worse, it’s clear the status quo is no longer an option. Credit unions need to embrace this change — and they need to understand how it will impact people, products and services. This means building environmental, social, and governance (ESG) considerations into all aspects of strategy, operations, investments and ultimately lending adjudication.

Lean into the cooperative advantage

Credit unions already have a leg up on banks in the domain of sustainable finance. You’ve codified your commitment to social responsibility in your underlying cooperative principles. You work together with your member-owners to provide necessary financial products and services. You serve your members while simultaneously making an impact in your respective communities.

But now you need to start thinking bigger. Because stakeholders increasingly expect that impact to stretch beyond the ephemeral, and far beyond your immediate vicinity, to match the global footprint that all businesses — and indeed all people have. It’s time to harness the full breadth of ESG topics to plant your stake in the ground, own your impact, and help build rigor in the trend toward sustainable finance.

Laying the groundwork for sustainability

Broadly speaking sustainable finance is the process of accounting for ESG considerations across all investment decisions. It is both a cultural and strategic shift that begins at the board level and trickles down through all levels of leadership to your front-line staff and interactions with your members.

The aim is to support long-term activities and projects which support, rather than consume human and natural resources. This is not just some idealistic vision, either. It’s a strategic imperative that defines what you do, how you do, and which you increasingly must embrace to stay competitive today and into the future.

MNP polled credit union leaders about sustainable finance at a recent conference. Some of our most eye-opening findings included:

- Nearly two thirds (63%) indicated it’s important to align personal sustainability and credit union priorities. Employees want to work with credit unions whose approach to sustainability matches their values.

- More than half (58%) of respondents are either not happy with or are not convinced that their credit union is pursuing necessary sustainability goals within operations or the communities they serve.

- More than one in three (38%) are either not or only somewhat satisfied their credit union has identified its positive and negative ESG impacts. This reveals a need for better impact analysis to develop awareness of what sustainable financing activities are being done within the credit union.

- More than one in three (37%) indicated they are not satisfied their credit union is doing enough to work with members to reduce negative ESG impacts or enhance positive impacts. There is an opportunity to show leadership in working with members to achieve longer-term sustainable finance goals.

Begin your journey to ESG maturity

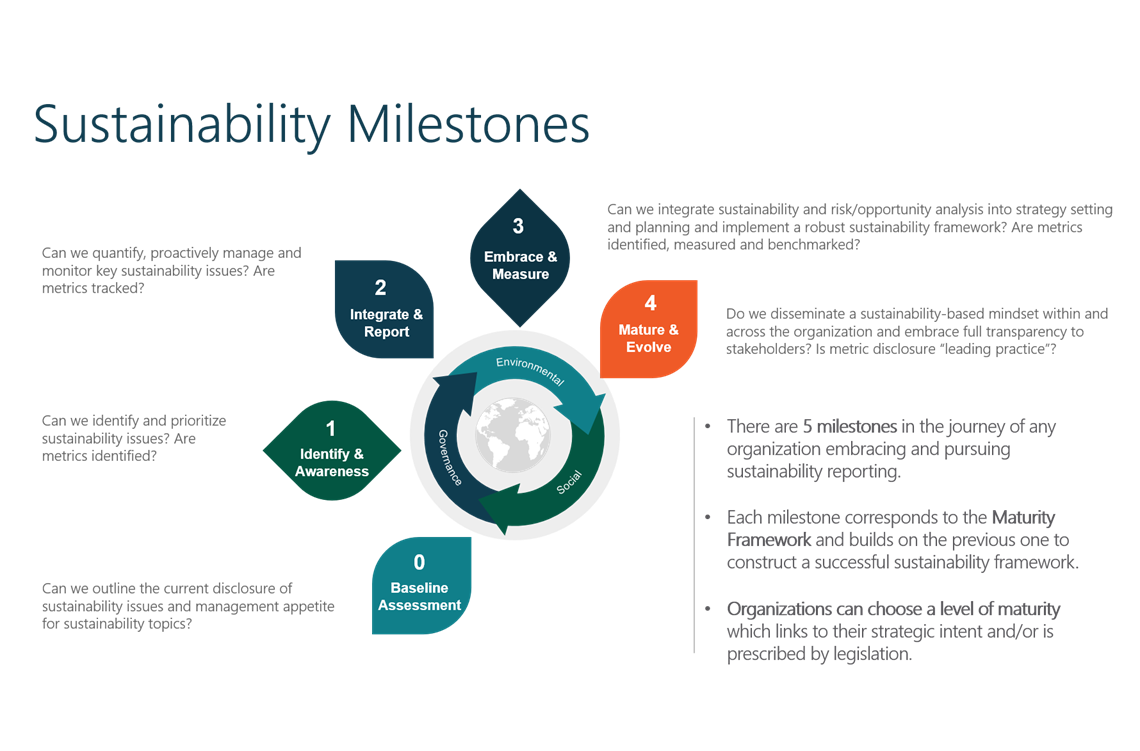

Adapting the Principles of Responsible Banking can be a challenge for any credit union — even with your underlying cooperative values. MNP’s sustainability maturity model can help you gain clarity on your current state, goals, and your best approach to ESG. We outline a clear, iterative process to optimize your impact and visualize your sustainability target. And, most importantly, help you build sustainability directly into your credit union’s strategy and operations.

This framework focuses on keeping things simple, which in turn enhances ESG adoption and increases understanding among the board the senior leadership teams.

We recommend two steps to get started with ESG:

- Conduct a baseline assessment of what you are currently doing today: This includes identifying key stakeholders, along with current ESG issues you’re currently measuring, monitoring and reporting.

- Creating an ESG business case: This includes clearly defining the benefits and costs associated with a proactive ESG strategy.

Sustainable finance is not about volume, but value to stakeholders. Be meaningful, deliberate and authentic in your ESG targets and disclosures. This will help you avoid accusations of greenwashing, build on your existing cooperative values, and create sustainable business opportunities for you and for your members for generations to come.

For more information on starting your ESG journey or to independently assess your current framework contact Edward Olson at [email protected].